A couple of links that some of you may find interesting:

1. Dani Rodrik writes once more about his programme: New Thinking in Development Studies.

2. NY Times argues that the legacy of Milton Friedman is not all gone in the times of turmoil.

3. Finally, Businessweek publishes the list of 50 most-innovative companies. See the shape of things still to come...

27 April 2008

Some interesting links...

Author:

REMY PIWOWARSKI

at

06:06

0

comments

![]()

Labels: Interesting links

23 April 2008

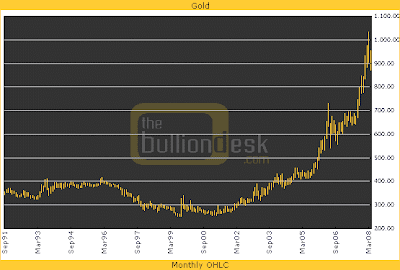

GOLD FEVER

Figure 1: Gold price in Dollar

Source: The Bullion Desk (2008)

While bonds and certificates of deposit depend on the creditworthiness of the issuer, gold investments are unbound to payment promises of firms or governments. Possessing physical gold represents an insurance against a devaluation of both currency and assets. Notwithstanding, this does not mean that the gold price cannot fall. Speculators also get in on gold and can contribute to overheating and fierce adjustments (the current gold price is below 1000 dollar). The rising gold price is also linked to excessive borrowing arrangements. Due to the lax monetary policy of central banks the share of credits in US GDP rose from 150% in 1969 to currently 340%. At the same time, investors’ risk awareness kept decreasing, as they could incur additional debts or pay debts with new debts without difficulty. Things are difficult when the “monetary fuel” runs short and the borrower is unable to repay his debts.

Hitherto the gold price often used to increase rapidly during phases of low or negative real rates (Fed fund real rates), i.e. whenever the inflation rate considerably exceeded interest rates (so that depositors could not make gains on their assets). In that case, the main disadvantages of gold investments, i.e. that one cannot earn interests or dividends, do not matter. Not only the fear of inflation but also the rising demand from newly industrialising countries inflates the gold price. More and more people from those countries can afford jewellery and gold bars. Accordingly,

Most of the gold is processed in the adornment industry. According to GFMS, jewellers processed 2407 tons of gold in 2007, which was 63% of the worldwide gold supply. The remainder dispersed among the industry, dental technicians, gold investors, and gold mines. Despite the rising gold price the worldwide gold mining remains stagnant. This can be explained by the ongoing increases in costs of material, energy, and logistics with respect to gold mining and the scarcity of new sources with high gold content. Moreover, there are hindrances such as institutional problems and time: The phase from gold discovery to commercial production takes at least seven years. Besides, projects drag on because of interminable licensing procedures and environmental protection amendments. Also, gold producers shrink away from investing in regions of political instability due to lacking legal security. Finally, investment opportunities deteriorated in light of the credit crunch and stock market crisis.

People who would like to purchase gold assets are advised to choose services offered by internationally famous and acknowledged bullion dealers. The prices of their products almost move together with the gold value. People who want to stock their bars and coins in bank safes should acquire sufficient information on insurance coverage; those who prefer to stock at home ought to make sure that the household insurance is adjusted. Also the home safe has to meet standards as required by the insurance. Alternatively, banks offer investments in gold (price) certificates, which are free of storage or insurance expenses. Moreover, they are more tradable compared to physical gold. However, gold certificates are bearer debentures and thus are receivables against the issuer. If the issuer’s credit standing deteriorates or if he becomes insolvent, the certificate owner also runs the risk of losing his stakes or parts of them.

Contrary to investment funds or Exchange Traded Funds (ETF), certificates do not represent separate assets which are protected in bankruptcy cases. An alternative to certificates are ETFs which purchase gold with investors’ money; the gold bars are then kept by a fiduciary. Investors who are only aimed at short-run gold price movements are not recommended to gamble with gold bars. Although the demand for gold has been increasing, the proportion of gold in investors’ portfolios is still very low, despite the fact that gold has been performing better than stocks for years, something that is expected to remain also for the next few years, according to the Dow-gold ratio. This ratio is calculated by dividing the average Dow Jones index level of a period by the gold price in US dollar of the same period. A decreasing ratio means that gold performs better than US stocks and vice versa. Even if this concept does not say much about the absolute price development, it proved to be a fairly good long-run indicator.

Figure 2: Dow-gold ratio

Source: www.chartoftheday.com (2008)

Central banks and IMF held 29955 tons of gold at the end of 2007, with a market value of 890 billion dollar. This gold largely stems from times when the issuance of paper-money had to be backed by gold. It is actually unknown which of this gold are still in the safes of central banks or has been already sold to the market. The

Links and References:

- http://www.ft.com/cms/s/0/aa269476-0013-11dd-825a-000077b07658.html?nclick_check=1 (about speculators who cut bets on rising gold price)

- http://search.ft.com/ftArticle?queryText=gold+price&y=5&aje=true&x=15&id=080307000043&ct=0&page=3 (about rising gold and oil prices)

- http://search.ft.com/ftArticle?queryText=gold+price&y=5&aje=true&x=15&id=080117000508&ct=0&page=5 (about declining jewellery demand in the face of rising gold price)

- Doll, F. (February 18, 2008). Omas olle Klunker. Wirtschaftswoche, pp.126-137

Author:

TheCooler

at

13:16

0

comments

![]()

22 April 2008

The Japanese Labor Market - Integration into the Capitalist Global System

Our author Barbara Kits prepared an excellent analysis of the Japanese labour market.

“The Japanese Economy: Problems and Policy Solutions” (unpublished),

by:

Zahra Biniaz, Petulia Fung, Barbara Kits, Delphine Maho, Hsieh Lea Tan

Author:

Barbara

at

10:03

1 comments

![]()

15 April 2008

CITIZEN OF EUROPE: How exchange rates influence migration.

Nevertheless, the number of Polish immigrants has started going down.

Why? Financial Times explains:

The wave of migration began when about a fifth of Polish workers were without jobs and Polish salaries were far lower than in western Europe. Over the last couple of years, however, official unemployment has dropped to 11.5 per cent, while the true rate is probably much lower. Pay packets are fatter – salaries rose in February at an annual rate of 12.8 per cent. The zloty has also risen sharply against both the pound and the euro, while Poland’s economy is also expanding much more strongly, with growth of 5.5 per cent expected this year.

As we can see, fluctuating exchange rates may have an impact not only on financial markets and trade, but also on the movement of people...

It would be actually good to do some regression analyses on what actually the impact of the falling pound is. Apart from pound, one could include many other variables: GDP growth rates in the UK, Poland and other countries, unemployment levels and take into account culture variables (individualism, mobility etc.). Furthermore, to get better results one could also make a panel data study: take data from various CEE (Central Eastern Europe) countries whose citizens migrated to the West.

But is the impact of the pound considerable? The idea is not mine, but I believe it just works as a deciding factor: you don't come back to Poland because the pound went down. There are other reasons: family, loneliness, depression etc. Exchange rates act like a "switch" - when your pay goes down significantly, you go back because of all other reasons. Money doesn't keep in the UK anymore.

Is the return good for British economy? I don't think so - of course British workers will be happier (migration from CEE did have an impact on wages and, thus, on unemployment), but it will only add to inflation problems (negative supply shock), and make the work of Mervyn King more difficult in the times of rising prices and stagnating economy...

PS: The report of the Office of National Statistics does show that unemployment among Britons went down. How come if standard labour economics theory says that two views, "immigrants take jobs that nobody wants to take" and "immigrants take our jobs", are just simplistic views of reality? In general, all else equal, the impact of immigrants should make wages go down. Well, here it seems that young Brittons give up competing with immigrants because of their small wage demands...

Author:

REMY PIWOWARSKI

at

10:47

0

comments

![]()

Labels: * CITIZEN OF EUROPE, Europe

07 April 2008

Can Gender Based Taxation boost female employment?

Last summer A. Alesina and A. Ichino, two famous Italian economists teaching at Harvard University and University of Bologna, proposed a gender based taxation (GBT) to foster female employment in Italy and, in general, in all countries with sharp gender differences in labor markets. They later published two very interesting papers (Gender Based Taxation and Gender Based Taxation and the Division of Family Chores), where they do some empirical calculations and they set up a model to explore gender elasticities in labor supply, considering elasticity both as exogenous and endogenous variable.

Their intuitive reasoning goes as follows: empirical evidence from many studies on OCSE countries shows that women have a more elastic labor supply than men, because of economic, cultural and biological reasons. On the contrary, men have a quite inelastic labor supply, since in the family the man usually works “in any case”, despite varying wage condition. A good way to boost female employment is therefore to tax women less and men more, as the Ramsey principle about optimal taxation would suggest.

This tax reallocation has two fundamental advantages: first, it changes the bargaining power within the couple, leading to more equitable redistribution of household duties and market activities, and to an increase in society welfare. Second, it can be implemented without any financial cost for the government, thus being easily approvable (compared with other expensive services reforms). This latter point comes again from elasticity implications: the raise in men’s taxation, and the subsequent raise in tax income – given low male elasticity – can greatly compensate a decrease in women taxation.

Alesina and Ichino’s calculations suggest that female tax rate can be 67% of male rate in Italy, while 91% in Norway (which has a opposite framework compared to Italy). Similar calculations could be carried out for many countries.

This GBT proposal arose, of course, many criticisms. T. Boeri et al. claim, for instance, that female labor supply is not so elastic: when the woman is the only worker in the family (e.g. single mothers), her elasticity is similar to the male one. Moreover, female unemployment is mainly due to lack of childcare services on the market and to cultural stigma on women not taking care of their young children; indeed, in Italy only 30% of women go back to work after having a child. An indiscriminate lower female taxation could benefit wives of stock-option-holding millionaires, while pushing single men on the black market to avoid higher taxation. An approach focused on specific categories of women would therefore be more advisable.

With presidential campaign going on in Italy, the topic of female labor participation has recently appeared again in newspapers. Somehow following economists’ suggestions, the leftwing candidate proposes a tax credit for working mother with low income. While this proposal would clearly benefit the targeted segment, it’s not clear why we should discriminate women who chose not to have children. Recent empirical evidence shows that women with higher income have more children: indeed, if we want to boost fertility, we should subsidize poor women without children.

Finally, while the tax credit proposal better deals with possible shortcomings of GBT proposal, it is not without costs. In this scenario, the government would actually raise fewer taxes, and budget coverage is not an easy matter, especially for countries with high deficit.

Given the many plausible benefits of GBT and its cost-free framework, why don’t give it a try as a starter for deeper changes?

Author:

Mariagiovanna Di Feo

at

19:08

3

comments

![]()